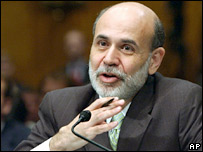

Fed chairman Ben Bernanke needs to keep an eye on inflation

|

US central bankers have held the country's key interest rate at

5.25%, breaking a two-year cycle of rate hikes introduced to slow a

rampant economy.

The news brings relief to millions of consumer and

business borrowers, but the Federal Reserve said it was still worried

about rising prices and wages.

It warned that rates could go up again if inflation carried on rising or the economy started overheating.

Many economists think a rate rise is likely by the end of the year.

"They are leaving the door open to a hike down the road.

A pause as opposed to the end of the cycle," said Shaun Osborne, chief

currency strategist of Scotia Capital in Toronto.

Federal Reserve chairman Ben Bernanke and his Federal

Open Market Committee face a conundrum in that raising interest rates

is the best way to tackle rising inflation - but because this makes

money more expensive it will slow or even stifle economic growth.

The Fed started raising rates from their historic low of

1% back in June 2004 for this reason - because it wanted to put the

brakes on a US economy that was showing signs of overheating.

However, recently there have been concerns that the 17

consecutive rate increases have been too effective - slowing the

economy too much or too quickly.

"I think, clearly, the Federal Reserve is worried that

the economy is going to slow down much faster than they would like,"

said Michael Cheah, from AIG SunAmerica Asset Management in New Jersey.

News of the Fed's rate pause sent US shares falling as

investors worried that the prospect of higher inflation would force the

central bank to raise rates again.

In the currency markets the dollar slipped against other leading currencies.

|